Expanding Quality Elderly Care Across Southeast Europe (2017–2020)

Between 2017 and 2020, SeneCura — part of the ORPEA Group — undertook a comprehensive regional analysis and strategic positioning effort to prepare for the expansion of high-quality elderly-care, rehabilitation, and assisted-living services across Southeast Europe. The program covered Greece, North Macedonia, Albania, Kosovo, Romania, and Croatia, all facing rapidly ageing populations, rising chronic disease burdens, and limited institutional capacity for long-term care.

Regional Context and Objectives

Demographic projections across the region indicated that people aged 65+ already exceeded 15% of the total population in several countries, with life expectancy continuing to rise. Yet institutional capacity was limited — for example, North Macedonia had fewer than 600 public nursing-home beds nationwide, while Romania offered roughly 3 beds per 1,000 elderly citizens. The initiative therefore aimed to identify viable investment locations, regulatory pathways, and partnership models for modern, socially sustainable care facilities aligned with European standards.

Greece: Fragmented Supply and Strong Demand

Greece’s ageing population, expected to surpass 27% over 65 by 2030, created strong pressure on a system still dominated by family care and a fragmented private market. Fieldwork in Athens, Thessaloniki, and other towns documented a wide range of operators, from large modern facilities such as Protipa Girokomeia Panorama and Agios Nikolaos Thermi to smaller faith-based homes like Agios Eleftherios and Kalos Samaritis. Despite quality examples such as Aktios Group (three facilities, >100 beds each), the sector remained under-regulated, with minimal state oversight and variable service standards. Meetings with the Ministry of Health and Enterprise Greece confirmed political openness toward PPP models and foreign partnerships in elderly-care infrastructure.

North Macedonia: Structured Entry and Institutional Support

In North Macedonia, where the population over 60 accounts for 15%, public facilities remain scarce and outdated. The 2017 market study highlighted only 567 public beds across the country, with private operators covering a similar number. Municipalities in Skopje, Prilep, and Bitola expressed readiness for new public-private ventures. The legal framework under the Law on Social Protection permitted foreign participation and concessions for elderly-care institutions, creating a stable environment for SeneCura’s potential entry.

Albania: A System in Transition

Albania’s demographic shift was advancing quickly: by 2031 people 65+ were projected to exceed 20% in all prefectures. Public nursing-home capacity of about 1,000 beds served mainly low-income elders without family support, while waiting lists reached up to two years. Private facilities were emerging, though still small-scale, charging between €120 and €500 per month. With the government encouraging public-private initiatives and the social insurance law providing clear licensing procedures, the environment was favorable for SeneCura’s model of integrated residential and day-care facilities emphasizing quality standards and staff training.

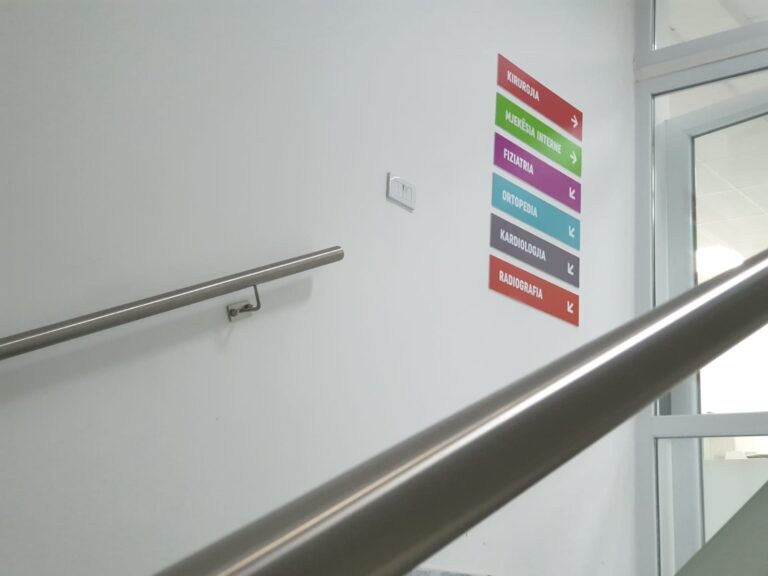

Kosovo: Early-Stage Development and Policy Momentum

Kosovo’s health and social system was still developing, with only one state-run nursing home in Prishtina (135 beds) and three small community houses offering a total of 50 beds. Admission was strictly limited to elders without family support, reflecting the enduring expectation of family caregiving. Nevertheless, new municipal projects and international cooperation frameworks were beginning to emerge, representing a high-impact opportunity for establishing first-generation elderly-care models aligned with European norms.

Romania: High Need, Large Market

Romania stood out as the region’s largest market — over 3 million people aged 65+, but institutional coverage below 0.4% of that population. Public and NGO facilities provided approximately 15,700 beds, while private homes operated around 250 facilities — many in Bucharest, Cluj, and Constanța — offering monthly rates from €500 to €1,100. The government’s long-term plan to convert 67 small hospitals into nursing homes underscored national recognition of the demand. For SeneCura, this combination of need, scale, and public-sector openness provided a strategic anchor for regional expansion.

Croatia: Model for Integration and Quality Benchmarking

Croatia already operated within an EU-aligned regulatory framework, with mature social-protection institutions and active health-tourism infrastructure. Its experience in dementia care, rehabilitation, and nursing-home certification offered a reference model for quality harmonization across the broader regional initiative, enabling knowledge transfer and professional training links to neighboring countries.

Regional Findings and Forward Strategy

Across all six markets, the 2017–2020 studies revealed shared structural needs: rapid demographic ageing, insufficient public-sector capacity, weak integration of services, and fragmented licensing and funding mechanisms. The coordination work resulted in a cross-country strategy promoting centralized knowledge-transfer platforms, adaptable architectural prototypes, pilot PPP projects in Greece and North Macedonia, and a regional framework for benchmarking and operational efficiency.

Conclusion

The SeneCura regional coordination phase (2017–2020) provided one of the most detailed mappings of the elderly-care landscape in Southeast Europe to date. It demonstrated that integrated, person-centered, and professionally managed senior-care facilities are both a social necessity and an emerging investment opportunity. The findings continue to guide policymakers, investors, and healthcare planners in shaping a cohesive Southeast European care network rooted in quality, dignity, and sustainability.

Driton Ukmata

Regional Development Coordinator – 2017 – 2020 SeneCura Group